define profit maximization in finance

Profit maximization the objective of the firm in the traditional THEORY OF THE FIRM and the THEORY OF MARKETS. Profit describes the financial benefit realized when revenue generated from a business activity exceeds the expenses costs and taxes involved in sustaining the activity in question.

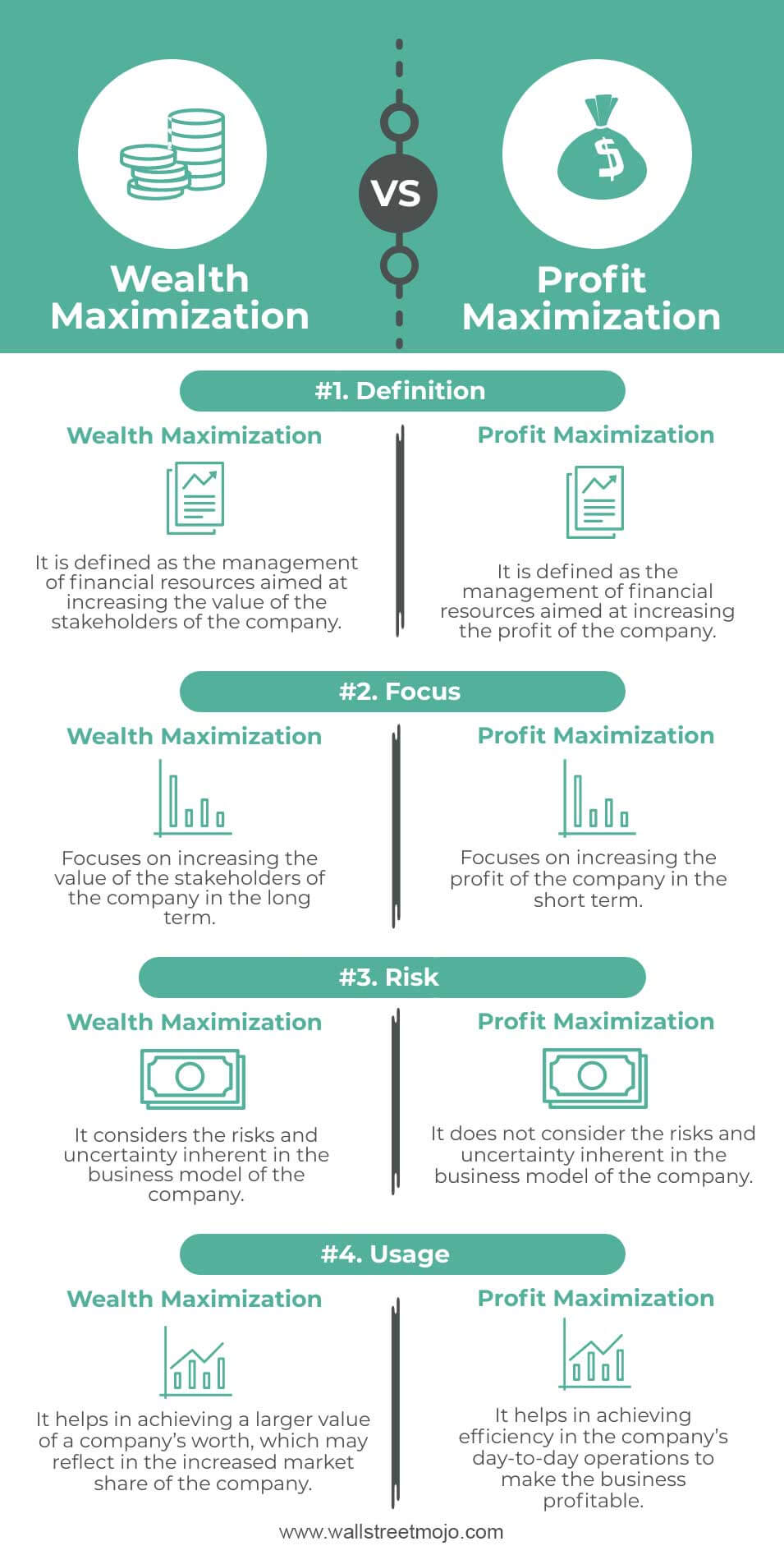

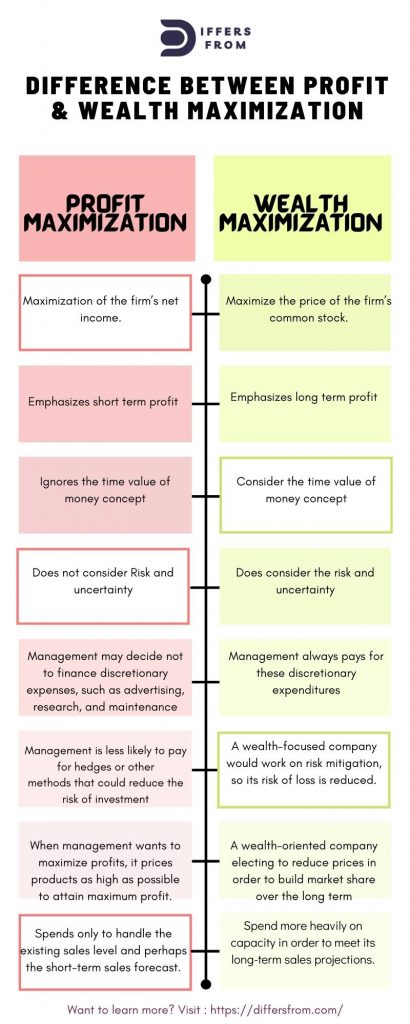

Wealth Maximization Vs Profit Maximization Top 4 Differences

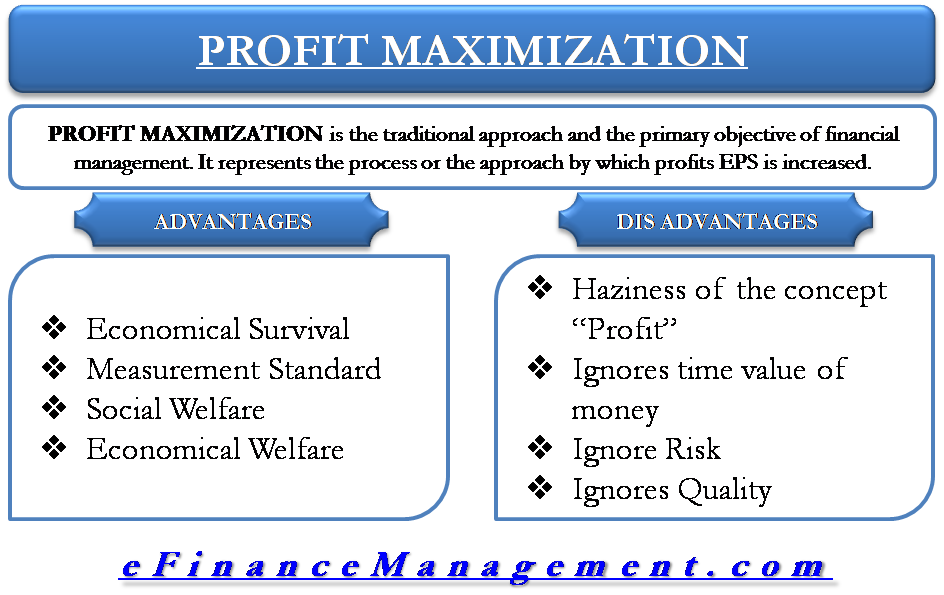

While earning a profit is the goal of every business profit maximization in financial management can put too much emphasis on profits and not enough emphasis on other aspects of the business such as customer retention social and economic well-being and other goals and aspects of the company.

. Firstly where TOTAL REVENUE TR exceeds TOTAL COST TC by the greatest amount. Defining the Principles of Corporate Finance. What do you mean by profit maximization in financial management.

Profit maximization the objective of the firm in the traditional THEORY OF THE FIRM and the THEORY OF MARKETS. Profit maximization means to increase profit of the firm. In the jargon of economists profit maximization occurs when marginal cost is equal to marginal revenue.

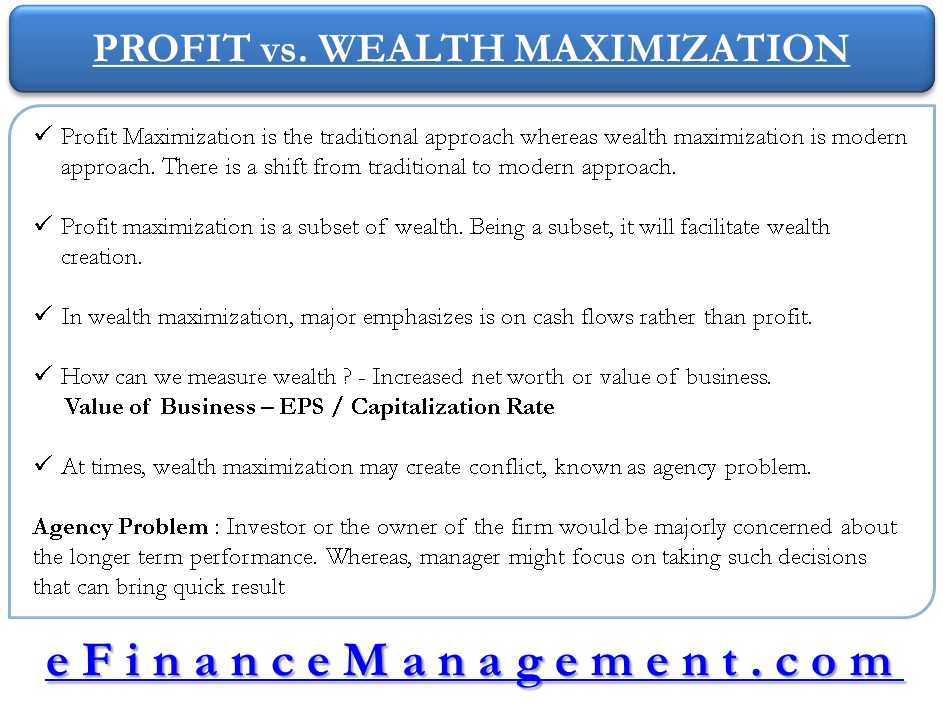

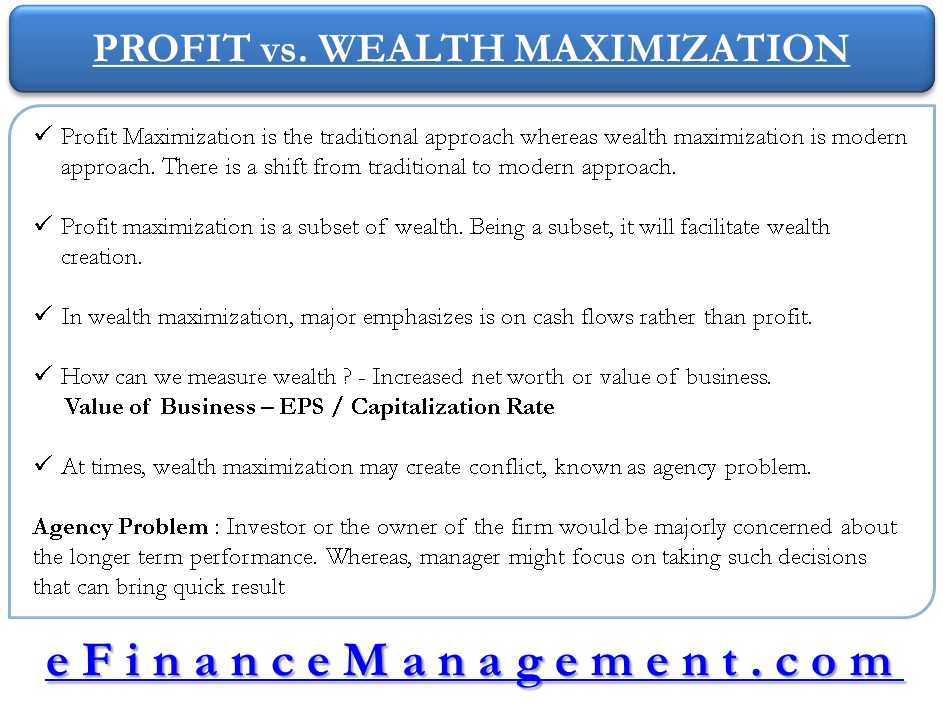

Profit maximization profit maximization an assumption that firms try to achieve the highest possible level of profits-- total revenue minus total costs --given their production function. The field of finance however makes a distinction between profit maximization and wealth maximization. Profit maximisation is all about a company reaching a level of equilibrium output so that its profits are at a maximum level and these profits are the difference between total revenues and total costs.

Profit maximization can be defined as a process in the long run or short run to identify the most efficient manner to increase profits. 6 profit sharing programs in which managers and employees receive a share of profits earned by the firm. The achievement of profit maximization can be depicted in two ways.

In simpler terms profit maximization occurs when the profits are highest at a certain number of sales. This means selling a quantity of a good or service or fixing a price where total revenue TR is at its greatest above total cost TC. According to financial management profit maximization is the approach or process which increases the profit or Earnings per Share EPS of the business.

How profit value risk and return affect a firms overall performance. It is a long-term goal and involves multiple external factors like sales products services market share etc. Profit maximization is the capability of a business or company to earn the maximum profit with low cost which is considered as the chief target of any business and also one of the objectives of financial management.

Therefore profit maximisation occurs at the biggest gap between total revenue and total costs. It is termed as the foremost objective of the company. The sales level where profits are highest is at the strategic level.

Profit maximisation is assumed to be the dominant goal of a typical firm. In economics profit maximization is the short run or long run process by which a firm may determine the price input and output levels that lead to the highest profit. Firms seek to establish the price-output combination that yields the maximum amount of profit.

What is profit maximization theory. Know the primary goals of corporate financial planning and control. The primary goal of financial management is shareholder wealth maximization which translates into maximizing the price of the firms common stock.

Firstly where TOTAL REVENUE TR exceeds TOTAL COST TC by the greatest amount. It is mainly concerned with the determination of price and output level that returns the maximum profit. Marginal Cost Marginal Revenue.

It is an important assumption that helped economists in the formulation of various economic theories. Which is the best definition of profit. In this diagram profit is maximised at Q where the gap between TR and TC is it widest.

In this approach actions that increase the profits should be undertaken and the actions that decrease the profits are avoided. The achievement of profit maximization can be depicted in two ways. Profit maximization is considered as the goal of financial management.

Profit Maximization is the capability of the firm in producing maximum output with the limited input or it uses minimum input for producing stated output. Profit Total Revenue TR Total Costs TC. This is consistent with producing up to the point where the marginal.

A firm can maximise profits if it produces at an output where marginal revenue MR marginal cost MC Diagram of Profit Maximisation To understand this principle look at the above diagram. Profit maximization is the capability of a business or company to earn the maximum profit with low cost which is considered as the chief target of any business and also one of the objectives of financial management. Profit maximization is the act of achieving the highest revenue or profit.

The primary objective of profit-oriented businesses is to make as much money as possible within certain constraints. Economists have long spoken of profit maximization as a guiding principle for profit-oriented businesses. PROFIT MAXIMIZATION AND THE FIRM.

Define and know the benefits breakeven and drawbacks of profit maximization. You might have seen the profit maximization formula presented in economics textbooks as. And hence Profit maximization objectives help to reduce the risk of the business.

It makes complete business sense to operate at a profit maximisation level anything less could result in a failing and costly business. Firms seek to establish the price-output combination that yields the maximum amount of profit. Define planning and control.

Wealth maximization goal of financial management. Neoclassical economics currently the mainstream approach to microeconomics usually models the firm as maximizing profit. So it becomes the most crucial goal of the company to survive and grow in the current cut-throat competitive landscape of the business environment.

Profit Maximization is the ability of the company to operate efficiently to produce maximum output with limited input or to produce the same output using much lesser input. According to Weston and Brigham The maximization of the firms net income is called profits maximization According to Khan and Jain According to this approach action that increase profit should be undertaken and those that decrease profits are to be avoided.

Financial Management For Profit Maximization Brief Discussion

Ca Foundation Intermediate Objectives Of Financial Management Profit Maximization In Hindi Offered By Unacademy

Is Profit Maximization An Appropriate Goal Management Guru Management Guru

Difference Between Profit Maximization And Wealth Maximization Differs From

Profit Vs Wealth Maximization As A Goal Of Financial Management

Objective Of Financial Management Growth Maximization Vs Wealth Profit

Financial Management Powerpoint Slides

Profit Maximization Meaning Model Benefits Limitation Efm

Is Profit Maximization An Appropriate Goal Management Guru Management Guru

0 Response to "define profit maximization in finance"

Post a Comment